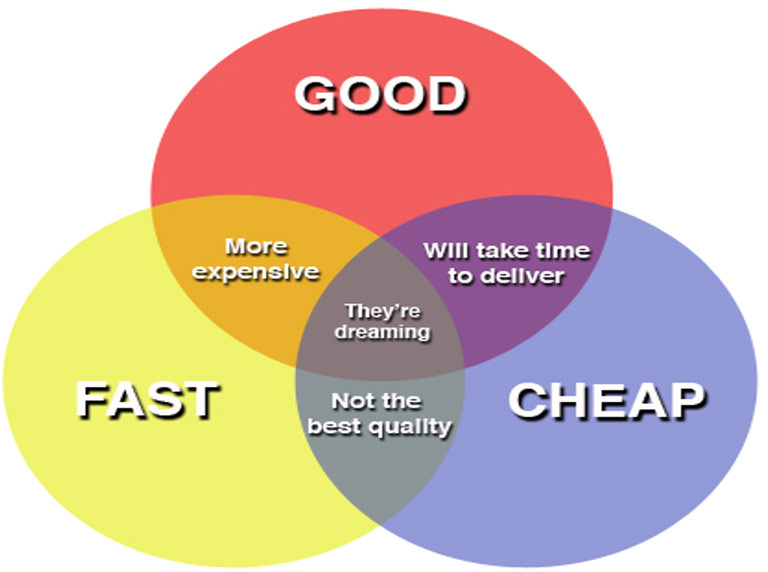

YOU CAN HAVE ANY TWO – WHICH WOULD YOU CHOOSE?

I recently attended the annual conference of AAIMCO, The American Association of Insurance Management Consultants, a group of 60 of the country’s smartest cooperative insurance minds (they made a mistake and let me in). Of all the topics covered in our three day session, the one that I retained was the comment in the title of this article.

I’m certain this is not original to that conference – I’ve heard it before referencing many disciplines and professions. But it certainly fits the Insurance Industry, doesn’t it?

Can you provide your clients your BEST product both FAST, and CHEAP?

Probably not! But neither can anyone else.

If something is Fast and HIGHEST QUALITY it is probably more expensive than other similar products.

If something is HIGH QUALITY AND CHEAP it will inevitably take longer to accomplish.

And if something can be delivered FAST AND CHEAP, it will likely not be the quality you desire.

I submit to you that, in our role as insurance consultants to our clients, our goal MUST BE TO DELIVER THE BEST QUALITY WORK WE CAN MUSTER AS EXPEDIENTLY AS POSSIBLE.

You will be best served to illustrate this concept to every new client (and reiterate it to all existing clients) to confirm that your objective for them is to get them your best effort as quickly as feasible without hurting the quality of the product you are delivering.

The other concept you must transmit to every client is the difference between COST and VALUE.

An old ‘beater’ car certainly “costs” less than a new car and some makes and models of new cars are much less expensive than others. But the reason most of us drive relatively new vehicles with more options than the basics of transportation is that the “value” we perceive is much greater in our option than the cost difference in our other options.

When differentiating your agency from your competitors you would be best served by telling your clients and prospects that you strive to always deliver the highest quality of insurance product at a competitive price in the marketplace as expeditiously as possible. If you appeal to the segment of the market who drives Mercedes rather than SmartCars, they will understand the concepts.

Agents who try to appeal to the lowest common denominator of clients and prospects find themselves in a death match against the price-driven direct writers and cut-rate insurers. They certainly exist in all marketplaces throughout the U.S. and they appeal to a segment of the population, but that segment should not be your target market as an independent agent. If you try to compete on speed, ease and lowest cost then you are appealing to clients striving for the cheapest coverage rather than those concerned with protecting their assets and families with the highest grade of insurance products. They may not know the difference but it is YOUR JOB to understand that all insurance products and carriers are NOT the same. If you abrogate that role you also reduce your impact as an insurance agency to that of a price quoter and will probably feel bored and frustrated most of your career.

Call us if you feel trapped in the price-wars – we can convert your agency into a Consultative and Relationship-Driven professional business again (856 779 2430).