Every agency has a life-cycle. It is born then goes through a period of growth and wonder as a young business. All agencies have difficult ‘adolescence’ periods as they change. Then it comes of age and reaches its peak performance and activity. Many reach a period of maturity when they achieve the respect and business referrals that only come with the confidence and knowledge that accompanies age. Then the business grows old and suffers atrophy, a wasting away through lack of activity and lessening of ability. However, the life cycle can be interrupted, accelerated and recovered based on the actions of its owners. If you can identify where your agency resides in its life cycle you can alter it.

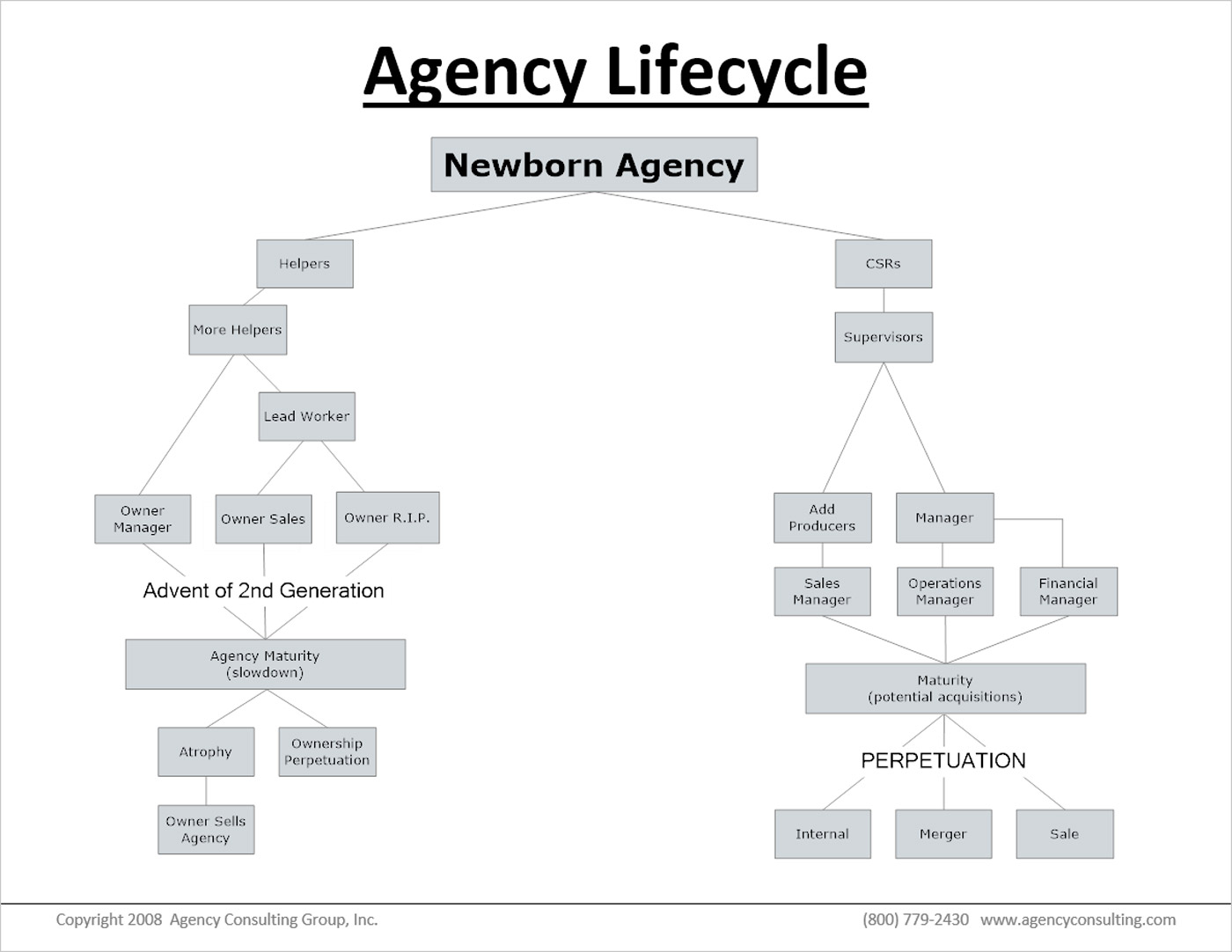

All agencies start with a single producer/owner who sells insurance for a living or from multiple producers who band together when they feel they are overwhelmed as individual sales agents and need assistance. As the producer builds the book of business he hires “helpers” to assist with service and administration. A single “helper” gets too busy to fully aid the producer and the agency organization begins. Before long the producer has written enough business to comfortably support their family and the agency employs a number of assistants. The producer becomes busy enough that they find that more time is being spent servicing the relationships already built than building new relationships. This is the first of many critical decision points that progress the agency life cycle toward one of many paths. The agency has reached childhood and now determines whether it develops into a business or into a support mechanism for the owner earning a living.

All small agency owners (under $750k in revenues) who have been in this position for a decade or more have matured. They have inherently made the decision that the agency is there to support the owner and his family. The business may have five or ten employees, but the coffers are drained every year and the success of the agency is determined by whether or not the owner has earned a strong living from the operation that year. In some agencies, the owner becomes a producer/manager and spends much of the rest of his/her career servicing and administering the business instead of making new relationships that turn into clients. The owner boasts that all of his growth comes from referrals, but, in reality, they MUST come from referrals because he has no time to market himself as he has in the past. He makes time for referrals because they are such “sure things” that he can’t deny them. You can identify agents in this stage of the life cycle by their admission that they are better producers than managers, but the circumstances of their business have forced them into a management role.

The life cycle track of the individual producer with a staff of “helpers” is one of a professional insurance agent who makes a living from selling and servicing insurance for his clients. As he ages into his fifties, the agent recognizes that he is earning a good living but has little chance of perpetuating his agency. His staff is not of the quality to assume control of his book of business and perform the same production efforts that he has exerted because he never hired or trained them to do so. Nonetheless, he feels that he can sell his book of business when the time comes to retire. The agent has pee-determined the life cycle for his business.

The small agent who has built his team around him as a sole performer may have one or more trusted employees who become lead workers, but the owner remains the primary arbiter of agency and personnel decisions. He is known as the “Lone Ranger” and feels alone in management responsibility most of the time.

On the other hand, the agent who grows his staff competence and management skills along with a producer force adds the potential of internal perpetuation to his options. The owners have leveraged their effectiveness, first through customer service representatives, then through additional producer who contribute to revenues and profits and, finally, through managers, if their businesses continue to progress through this pathway in its life cycle.

Some relatively small agencies, around $1 Million gross revenue, initiate non-owner managers to help grow the organization. Most agencies must have some form of management structure by the time they reach $2 Million, although many of these agencies use former producer-owners in this role. Few agencies can exist past $3 Million of revenues without professional managers who are not also producers or account managers.

The reason that some smaller agencies hire or promote managers is the foresight of the owners who wish to continue to grow their businesses. This is not easy for most small agency owners. They are used to making all of the decisions and know that they will continue to be accountable for the agency’s successes and its failures. But those agents who can get past the major learning experience, delegation of responsibility and of authority, without losing control of their businesses become large agency owners.

The reason that the larger agencies must adopt professional managers as they continue to grow is that most producer-agents find themselves less than adequate in management roles while they are stellar in sales, client relationship and company relationship roles. Agencies at $2 Million generally have between 20 and 25 employees. There are too many procedural, workflow and personnel issues at this level of employees to be handled casually by an agency owner-producer. At $3 Million to $4 Million of revenues, the agencies are large enough to fall under federal employee regulations that truly imperil any employer (including agency owners) who are not paying attention to personnel issues.

The agent who is building an insurance business instead of an insurance career learns to delegate authority and responsibility while maintaining management control of the business. Unsuccessful producers are culled, or they will eat the agency’s resources like a cancer. More successful producers are acquired in various ways, including acquisition, until a Sales Manager is evolved. Meanwhile the support team manager becomes a full Operations Manager leaving the owner to manage growing customer and carrier relationships.

Maturity in both tracks of agency development is the most dangerous time for any agency. If the excitement and growth diminish while either form of agency continues to profit and/or support the owner’s lifestyle it promotes lethargy and apathy that leads to ATROPHY.

The atrophy in an agency supporting an individual performer is defined by a general slowdown and increased frustration by the owner. The atrophy in larger and professionally operated agencies is defined by a slowdown in growth, the maintenance of an acceptable profit level or a slow deterioration of profits and the hands-off operation of the business by the owners. Many agency owners become R.I.P. after as little as 10 years and many more enter this state after 20 years. R.I.P. is the state of Retirement In Place. The attitude is that the owner has “paid his dues” and now deserves the rewards of his labors. Many a “scratch” golfer is an insurance agency owner who is R.I.P. It’s not the fact that the agent is a golfer that reflects this status – it’s the fact that he devotes more time to the hobby than to the productive growth of the business that defines the R.I.P. position.

The result of Agency Atrophy in the individual performer agencies is the sale of the agency or its perpetuation because the owner has lost the heart to continue. It certainly happens to owners in their 70’s, but we’ve seen this occur in owners in their mid-fifties, as well. Agency Atrophy in larger agency businesses happens as well. Many times, it is healthy for the industry in the area, permitting the ‘Young Turks’ to grow their businesses at the cost of the older more staid agencies who are no longer at the cutting edge of the industry. The youngsters get the business because they are hungry and, on the attack, while the larger, older agencies are on the defensive (protecting their renewals). The result is internal perpetuation, merger or sale as the agency owners collect their asset value in retirement.

Happily, we can report that both individual career agencies and agency businesses can interrupt the condition of Agency Atrophy, and are doing so in growing numbers. The required changes are EXCITEMENT and GENERATIONAL PERPETUATION. If the owners can re-invigorate themselves, they can re-build those atrophied sales skills and business skills within themselves or within their agencies.

Excitement grows from innovation and forward movement. The answer to atrophy is perpetual movement. Keep moving and you don’t die. Hire new people. Start new divisions. Grow geographically. Acquire agencies. Mature agencies snap out of maturity and back into Peak Performance by adopting an attitude of Celebrated Discontent (stealing a term from Steven Covey). This means that you should be rightfully proud of what you have built and what you are but can never be satisfied in that state. Celebrate your victories and immediately determine what you can do next to be better.

If you personally can’t get excited anymore, the generational perpetuation can solve that problem IF THE NEW GENERATION IS, OR CAN BE MADE, HUNGRY. How do you make someone hungry? Make the transition of ownership the light at the end of the tunnel. But do so at a cost that can only be accomplished with growth beyond the agency’s current state. When an agency owner is considering perpetuating the business, the first thing most do is value their agencies (we do many valuations each year – call us if one is needed 800-779-2430). The valuation is done based on the conditions of the perpetuation plan.

Obviously this can be done in either form of agency. DON’T GIVE AWAY THE AGENCY YOU’VE WORKED FOR ALL YOUR LIFE. You built the agency either to support your family or to build a strong and viable business with a hunger and panic in your belly and a fear that not growing and selling insurance would imperil your business or your family. Transfer that hunger to the next generation and you’re actually doing them a favor. Otherwise, they inherit a strong and going business or income stream and can start life in the Atrophy stage of existence – not needing to do anything more to earn a living.