By: Vincent Leonard, Litigation Coordinator, Searcy, Denney, Scarola, Barnhart & Shipley; https://www.searcylaw.com/

As I write this, please forgive me as I am not of sound mind.

For what seems the millionth time someone has just told they have “FULL COVERAGE” on their insurance policy. Here is the thing and I will bet the, albeit quaint and small, Leonard Farm on this. You don’t!!!! You have nothing close to full coverage because frankly I don’t believe such a policy exists. What really shocks me is the level of sophisticated people who use or allow the use of this term to be thrown about, including insurance and legal professionals. Every time I am told this on an initial meeting I always feel like good ole’ Charlie Brown. Good (grief and yikes!).

This just in….. if you are hanging out with an insurance or legal professional who uses such a term as “full coverage”, turn around and flee just as fast as you can. Someone’s full of something, and it probably isn’t “full coverage” and if you believe what the state requires is enough, then think again. The state requires a car owner in Florida to carry Personal Injury Protection and Property Damage. That coverage, a crash, and a cup of coffee will buy you a headache that will keep you up all night.

So, is “full coverage” what financial companies require you to have when you finance or lease, right? Nice try, but you are 0 for 2. The only coverage they require protect them, not you. Critical coverage like Uninsured/Underinsured Motorist (UM), which might protect you or your loved ones, is of no concern to them.

Wait I‘ve got it! Full coverage must be what you get when you ask agent/broker for it and they are not fully focused on the commission or just making the sale. Of course, all at a price lower than ice in the North Pole. ………..

….Sorry, for the pause I had to catch my breath from laughter. I hope I haven’t pulled something. But I digress. You my friend are on fire, like literally, as the steam will come out of your ears after an accident when you find out you’re up the creek without a paddle. You are now 0-3, and when you call for help from your carrier or law firm you will be likely be called out at the plate.

Ok, so enough with the snarky bad news, right? I hear ya.

So what should you do? Do not wait. Get on the phone with your current agent or broker, or one out there that will be upfront with you, listen, and resist the urge to sell you a policy just for the commission. Find someone who will ask you the right questions and listen to you, about protecting your assets and your loved ones. Then go through your policy and find out exactly what coverage you have and how much. What else might you be missing?

As an example, one of my daughters, who recently graduated from college is in the Army stationed at Ft. Bliss Texas. She just bought her first new car and needed her first auto insurance policy. She sought my help and although I try not to be the typical helicopter parent, this insurance thing is tricky, even for me. I wasn’t going to just brush her off. So I took to my helicopter.

I had to acclimate myself to Texas laws and requirements and my daughter’s needs at this stage of her life. We spoke to 3 agents/insurers. All but one quoted her insurance, and other than name rank and serial number stuff, they never asked a single meaningful question about what she needed or wanted. One said that I “ask a lot of good questions”, and I was thinking, good thing since he had supplied little in the way of valuable information. But you get the point. If there isn’t dynamic back and forth with the agent/broker asking questions and you asking follow up questions, chances are this thing just ain’t working. It took a little time, and she clearly didn’t land on the lowest price helicopter Dad’s, “final answer” moment of truth. I wanted my daughter to understand what we were doing and why it’s not just about the price. Afterward she said this “being adult” stuff is hard work. Ironically, this sentiment coming from a kid who would rather break down her weapon in a dusty foxhole in the pitch black then learn about insurance. Yes, I thought to myself this “adulting” sure is hard work kiddo. Here’s the thing, sadly, this “adulting” isn’t over for her, or a good insurance agent. You see the policy she just picked out at age 23 may not be the right policy for her next year or 5, 10 or 20 years from now!

When I drive to a client’s beautiful home and step into a home with nice furnishings I am still very shocked when I find out they have a meager $10,000/20,000 Bodily Injury policy with no UM. My heart literally sinks. Understand this, when you have assets and the means to pay up, and you injure someone that $10,000 is not likely going to keep you and your life savings safe!! Having no Uninsured/Underinsured motorist coverage for them or their family is a dangerous decision; particularly considering that Florida has one of the highest rates of uninsured motorists flooding our streets. It might surprise you to know the number of times people, even with some insurance, still have had to directly pay from their own savings and investments due to horrible injuries they or their children caused. Why? Simply, because they failed to carry enough or the right insurance. Remember, when planning your retirement portfolio, you must not only focus on how to accumulate wealth, but how to protect it. And, I’m not talking about market or interest rate fluctuations!! Also remember, as my Dad use to tell me, it takes two to tango. So if you’re out there looking for the lowest quotes without comparing coverages or limits of coverage you are playing a losing game my friend. This is a lesson you won’t want to learn when it is too late and from someone like me explaining it to you either as a plaintiff or a defendant, too late, after a tragedy has happened.

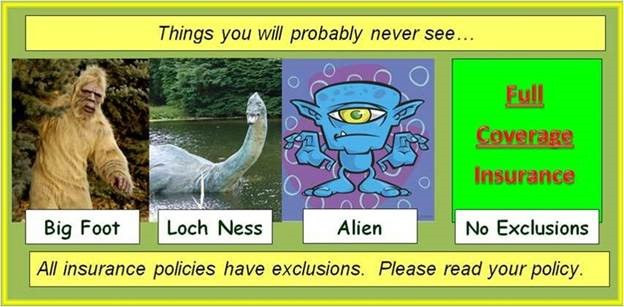

Well, you may not, but I sure feel a little better. I have vented and hopefully have done my small part. The two key learnings? Find an agent or broker who communicates with you well and whom you can trust. Second, NEVER and I mean NEVER use the term “Full Coverage” especially around me. Finally, above I shared with you a cute image of some mythical creatures that my friend’s Brent Winans, Vice President Clear Advantage Risk Management and David Thompson, Education Instructor with the FAIA (Florida Association of Insurance Agents) put together after they had to endure one of my silly rants on this subject in a joint presentation to their fellow insurance members. I hope you enjoy it as much as I did. Even though we are often on the opposite side of the fence we share common core belief systems. We have a mutual goal to better educate consumers and insurance & legal professionals on critical matters important to all of us. It is just nice to know that I am not the only one out there on this important quest!