Once the holiday season ends and spring nears (March 20, 2022) the dreams of every agency owner drifts to the time we are most pleased to see all of our wonderful Carrier representatives – CONTINGENCY TIME!

We’ve dug through our agreements and prompted our representatives to give us hints about the size of our expected bonuses, and are grateful for whatever we receive. As many readers know, we have for many years, petitioned our carrier friends to convert their contingency programs to commission changes based on three year loss ratios to permit us to operate our agencies on monthly income from our core customers and carriers instead of annual bonuses that must be kept and doled out frugally if we need that money to operate our businesses.

When commission rates were sufficient to sponsor our staffing, acquisition and automation expenses, contingency income was a boon to the agency, providing seed money for acquisitions, for growth initiative and for investments in personnel and management. As the average agency commission rate on premium based contracts continues to feel downward pressure (now slightly less than 12%) more agencies need their contingency income to cover basic occupancy and staffing costs.

Obviously we can’t increase your contingency contracts. But many agencies and cluster groups throughout the U.S. find themselves with group contingency payments that need to be distributed among several locations, owners or agencies.

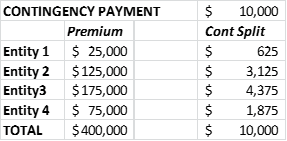

Historically, the simplest way of distributing contingency payments has been by premium. If a group (aggregator, cluster, multiple owner/location entity, etc.) enjoys a contingency payment from a carrier, they split it according to the ratio of premium of each component of the group.

The more premium that an entity drives, the more contingency it receives:

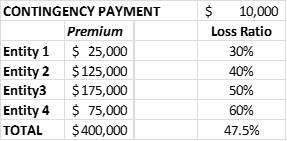

Unfortunately that calculation ignores the loss ratio differences between the entities. Today most carriers will offer sub codes for each entity in a group that will identify the more and less profitable components of a multi-dimensional group. For example, if the cause of the contingency payment was an overall loss ratio of 47.5%, shouldn’t the components who enjoyed less than the agency average loss ratio, enjoy a greater part of the contingency than those whose loss ratio actually negatively affected the agency’s overall contingency?

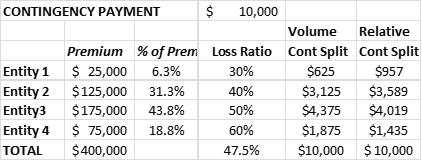

Under these circumstances the fair and equitable way contingency is ACTUALLY EARNED by each component should be a combination of both volume AND loss ratio relativities. Agencies whose loss ratio is higher than the average loss ratio of the group earn less and agencies whose loss ratios are lower than the group’s average earn higher levels of contingency.

Agency Consulting Group, Inc. has created a program that allows multi-dimensional insurance businesses to split contingency into its component Earned Contingency for each carrier represented using BOTH volume and loss ratio relativities to calculate contingency due to each component due payments. The Fair Share™ Contingency Distribution Program© will calculate the distribution of contingencies for up to 17 carriers and six segments of distribution (can be tailored for more of either) over five years of volume and it provides invaluable statistical data regarding the relative profitability of each entity in the group. If you would like to discuss how the Fair Share™ Contingency Distribution Program© can help you, please call Al Diamond, President, Agency Consulting Group, Inc. at 856 779-2430 or email al@agencyconsulting.com