Whether you have an agency with several profit centers or several entities sharing contingency income, many agencies have grown to understand that splitting contingency income by premium volume, alone, is an insufficient and inequitable method of sharing this bonus income stream.

The LOSS RATIO of the individual entities bear a great importance to the amount of contingency income that each should receive.

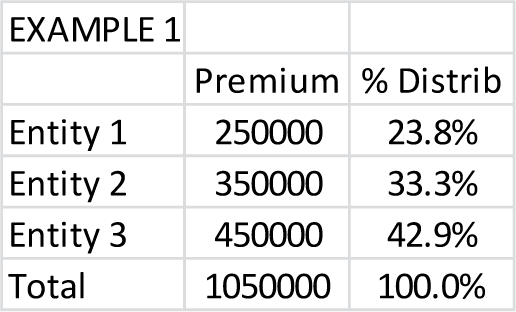

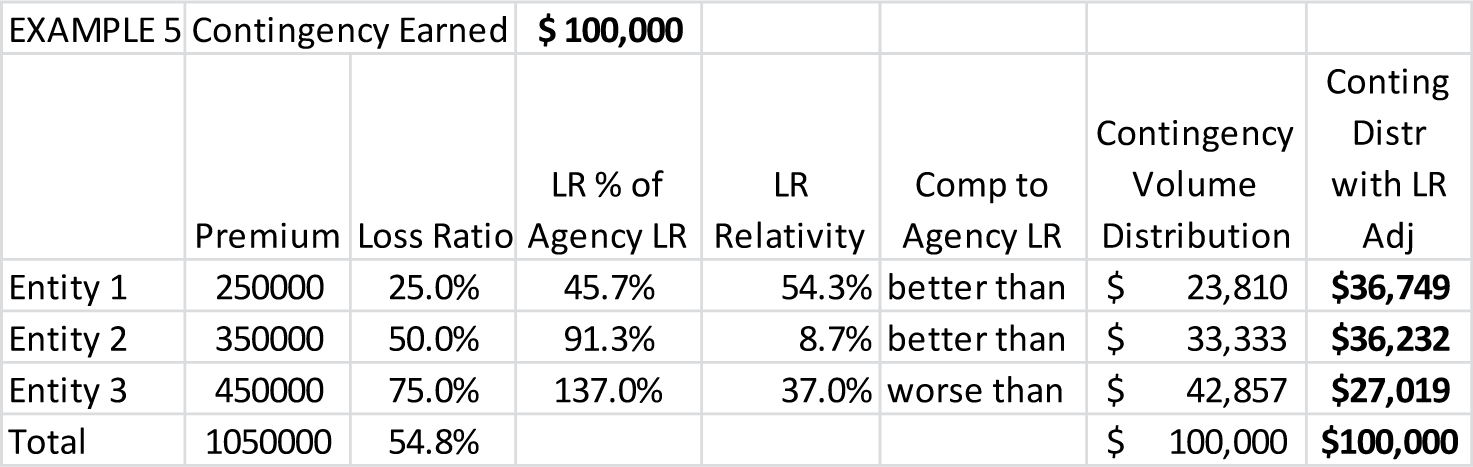

In the example, below, each of three entities are represented with share representations of premium written in a specific carrier:

If percentage of premium, alone, were the only consideration, Entity 1 would receive 23.8% of the total contingency, Entity 2, 33.3% and Entity 3, 42.9%.

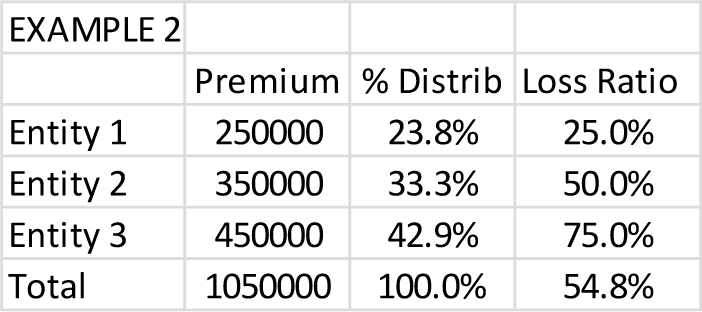

But what if the loss ratios of each entity were reflected?

Would each entity deserve a share of contingency based on premium alone? In all likelihood Entity 3’s loss ratio decreased the amount of contingency more than their premium generation increased it because all carriers are more sensitive losses in contingency calculations than to volume.

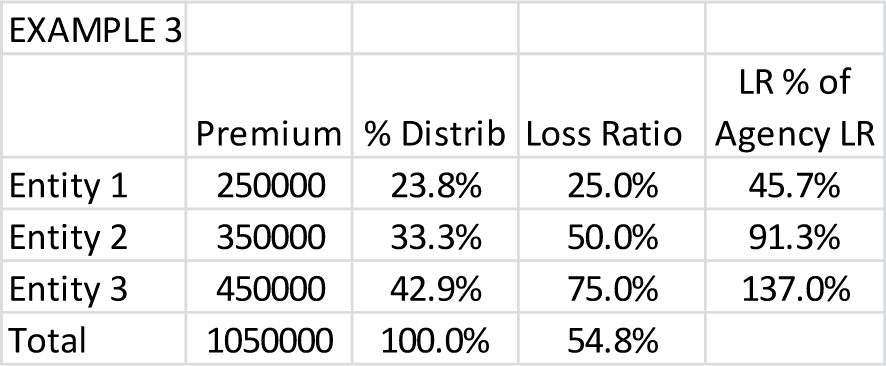

The step needed to properly calculate the percentage of contingency that each entity deserves is to determine how each agency’s loss ratio compares to the combined loss ratio of all of the entities.

Typically, whether a cluster group, Virtual Insurance Agency or a single agency with multiple profit centers, the advantage of conglomeration is for larger total volume insulating all of the entities against loss of contingencies. But a comparison of the LR of the specific entity to the loss ratio of the group (Example 3) gives us the critical ingredient for Loss Ratio Relativity. Knowing that Entity 1’s 25% loss ratio is 45.7% that of the 54.8% loss ratio of the group (.25 divided by .548) permits us to determine the Loss Ratio Relativity (Example 4) of each entity to the whole.

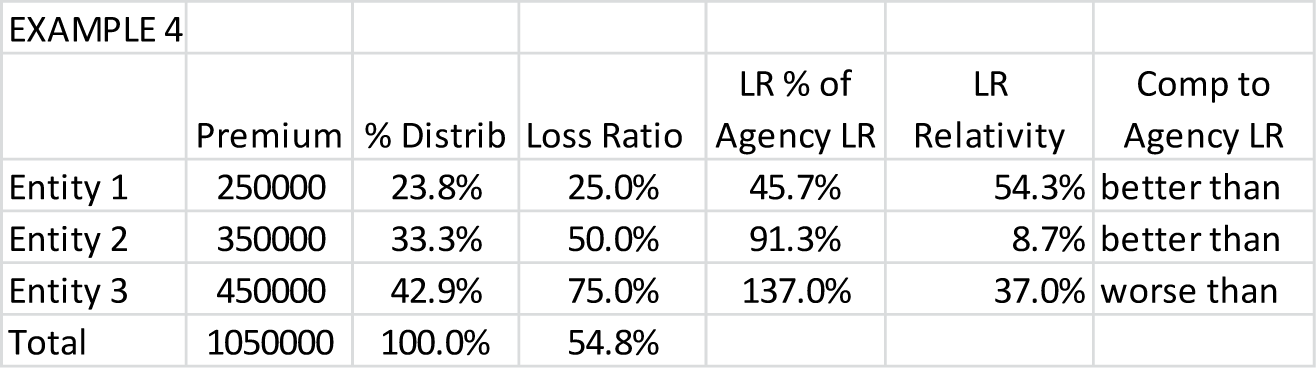

The Loss Ratio Relativity (the comparison of one entity’s loss ratio against the combined loss ratio of the group) defines each entity’s loss ratio in terms of how much BETTER THAN or WORSE THAN the group loss ratio it is. This is accomplished by creating the ‘inverse’ of the LR comparison of each agency to the total group loss ratio. Entity 1’s loss ratio at 25% is 45.7% that of the total group loss ratio (54.8%). The inverse of that percentage is 54.3%. This relativity defines how much better or worse the entity’s loss ratio compared to the loss ratio of the entire agency for the carrier.

If $100,000 of contingency was generated from the carrier in question, Example 5 shows the final distribution of contingency to the three involved entities by first calculating the relative volumes and then the Loss Ratio Relativity of each entity to the whole.

The same amount, $100,000 distributed inclusive of loss ratio considerations would give preferential treatment to entities with loss ratios BETTER THAN that of the whole agency and would discount contingency payments to agencies with worse loss ratios than the agency as a whole. As noted above, even an entity with almost 43% of the premium generated for a carrier (entity 3) would find their portion of the contingency reduced to 27% based on their significantly higher loss ratio that, in all likelihood, reduced the contingency payment substantially more than their volume increased it.

An entity within a central agency (like a cluster or a multiple location agency or a service center or an agency with multiple partners, each responsive to their own underwriting) would find better control over the fair distribution of contingency income by considering both premium generation AND loss ratios before simply distributing or crediting contingency amounts to each participating entity.

This concept may be applied to all multi-unit (office, division, owners) agencies as well as to Virtual Insurance Agencies (the next generation after clustering) and Cluster Groups to more fairly distribute contingency income from one or more carriers.

In order to show the entities the benefits of a fair distribution of contingency income through loss ratio as well as volume considerations, we have found that a one to three year look-back period during which the concept is tested is most appropriate. By defining both volume-distribution and loss ratio comparisons for five years the entities involved will see the distribution of contingencies that would have resulted in this form of distribution. It also reflects the long term comparisons of loss ratios of each entity within an organization.

Agency Consulting Group, Inc. conducts Contingency Analyses for insurance agencies and employs a worksheet that will provide the agencies both historical and subsequent contingency distribution including volume AND loss ratio.

Agency Consulting Group, Inc.’s Contingency Distribution Program includes:

– Individual entity loss ratio statistics by carrier by line of business and by Personal vs. Commercial Lines for every company represented for as much as five years

– Carrier loss ratio’s across all entities by line of business and by Personal vs. Commercial lines over as much as five years.

– Total agency loss ratio’s by carrier by line of business and by Personal vs. Commercial Lines over as much as five years,

– Total agency loss ratio’s by line of business (across all carriers)

– AND, OF COURSE, THE CONTINGENCY DISTRIBUTION ANALYSIS REFLECTING THE AMOUNT OF CONTINGENCIES EARNED BY EACH ENTITY WITHIN THE GROUP FOR EACH OF FIVE YEARS BASED ON BOTH THE PREMIUM DISTRIBUTION AND THE LOSS RATIO RELATIVITY OF EACH ENTITY TO THE WHOLE.

Please contact us 800-779-2430 to have Agency Consulting Group, Inc. provide your agency with a Contingency Distribution Program.