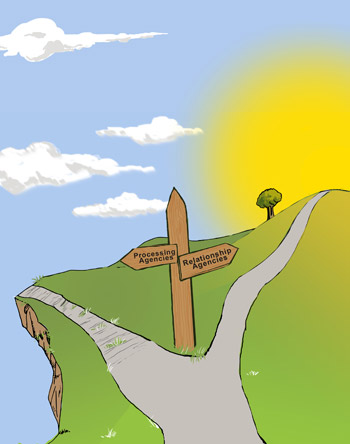

When your agency reaches the crossroads, which way will you go? Will you even realize that you have reached the crossroads?

The insurance agency business was on an even playing field for many generations with agents of specific and multiple-carrier representation and brokers accessing carriers directly on behalf of their clients.

The Slippery Slope

But the road started descending on a slippery slope in the 1960’s and has been causing your father’s agency to look different than your grandfather’s agency and your agency to look different than that of your father or predecessor. That descent began with the simplification of coverages into auto, homeowners and commercial package policies. This sped up the creation of relatively standardized insurance programs when each agent had to create a specialized program for each client previously. It got easier to do business in some ways and more complex to process in others.

Then, later in the 60’s and 70’s the rate of change accelerated as the road continued to decline with direct billing, the bane of cash management but the savior of productivity as agencies no longer had to deal with being the “bank” for clients. The carriers took control of billing and we’ve never looked back.

The 70’s and 80’ further accelerated agency functions with agency automation as a response to and parallel to the advent of alternative distribution systems for insurance products that utilized automation from their beginnings.

We’ve seen no slow-down in the pace of change in the 90’s and into the 21st century as underwriting has become streamlined and automated and changes have taken place in commission rates, workflows and workloads for agencies and carriers alike.

I’m afraid that many agents have held on for dear life and are missing the fact that a crossroads are facing them. If no thought is given to changing the way agencies operate, the pace will continue to speed agencies along the most traveled direction instead of taking the newer direction of agency development. Unfortunately the common road, still declining, is aimed at a cliff — and oblivion.

Without a change in course agencies will have to merge or sell as the principals retire because they will find their productivity declining further as price-quoting will become ever harder to accommodate in face of ever-more-stringent and flexible competition.

And the crossroads is even marked. On direction is toward “Processing Agencies” and the other sign directs us toward “Consultative Agencies”. In one direction we will become better processors of transactions at the same time that intelligent underwriting and services like Google Insurance is creating portals that will permit simple clients to purchase and transact P&C insurance policies like they do life insurance already – through on-line shopping.

Consultative Approach to Agency Operations

Professional agents have known for decades that there are sufficient types of life insurance programs available that simply shopping on line for cheapest price is NOT serving the protection needs of the insurance buying public. But insurance companies claimed that the life insurance product is generic and they have publicized heavily the availability of life insurance on-line and direct. A large number of buyers are using these services every year, sometimes to their direct detriment. We know that direct writers and carriers, themselves, are trying to convert P&C customers to the same price-driven-only model. And the results are reflected in the growth of direct writers against stock and mutual companies supporting more traditional, agency marketplaces.

We have already seen ‘Flo’, the gecko and a myriad of other shills make similar claims as life insurance of personal lines products. “Products in a box,” “Choose Your Own Rates” and ‘Save X% in X minutes” are only a few of the many gimmicks in use. And their efforts, accounted for in billions of dollars of advertising, have borne fruit and have eroded the independent agents’ market share in personal lines.

We are now seeing a similar trend in commercial lines from the smaller account forward.

Agencies’ True Advantage

The advantage that agents have over the direct writers and most other alternative product delivery systems is their knowledge base of insurance products, of the marketing area, and of the clients, themselves. Agents have the opportunity to tailor insurance programs to the specific needs of the client. The road to Consultative Agencies requires agencies to TURN THEIR ORGANIZATIONS — not a radical turn — but a distinct change, nonetheless, from the Price/Quote system that puts you in direct competition with the low-priced alternatives to the Consultative system that is the highlight of Relationship Selling.

The direct writers and other delivery systems will not be able to become consultative — they are trying to sell insurance at a distance on line and over the phone. They can no sooner become effective consultative professionals than they could remedy patients’ medical problems via internet and over the phone. There are still some things that are best handled in person – medical well-being and insurance programs are two examples.

Agency Consulting Group, Inc. Sponsoring INSURANCE AGENCY TRANSFORMATION

Over the course of the next year or two Agency Consulting Group, Inc., in concert with PowerHouse Learning will be bringing INSURANCE AGENCY TRANSFORMATION to as many states as we can in live half-day and full-day seminars sponsored my many of your State Associations.

We will give you a menu of changes that are needed in every agency that is willing to turn in the right direction when they reach the crossroads – away from remaining a processing shop that quotes coverage against the other insurance alternatives and toward creating, building and maintaining relationships with every client to become as close to the client as is their family doctors – trusted advisors.

While Agency Consulting Group, Inc. and PowerHouse Learning have already helped hundreds of agencies identify the changes needed and helped them implement them to assure a conversion of character for the new relationship agencies, the seminars will not only give you the cutting edge changes that are necessary for agencies, but it will also provide you all the material you need to start the change process yourself.

We encourage you to contact your Association and ask them to call us (800) 779 2430, if we haven’t called them yet, to offer the IAT seminar in your state. The seminar will provide you with both concepts and take-home material that you can use to implement change in your agency. Included in our program is:

The Asset Protection Model of Relationship Selling – teaching consultative approach to providing insurance that has been the keystone of most great insurance agents over the years.

Making your agency a CUSTOMER-CENTRIC business – having all employees concentrated on the best interest of the customer – always

Incentive Compensation – converting from longevity based compensation to incentive based compensation without the use of commissions

Producer Management and Incentive for Growth – Setting up programs that assure continuous growth from producers without them ‘Retiring in Place’

Implementation Guide – While all material will be provided to you, we now have guided management that we will continue for your agency (if desired) on a monthly basis to assure you that the conversion you seek will be implemented

Please call us if you would like to speak about TRANSFORMING YOUR AGENCY (800 779 2430).